All Categories

Featured

Table of Contents

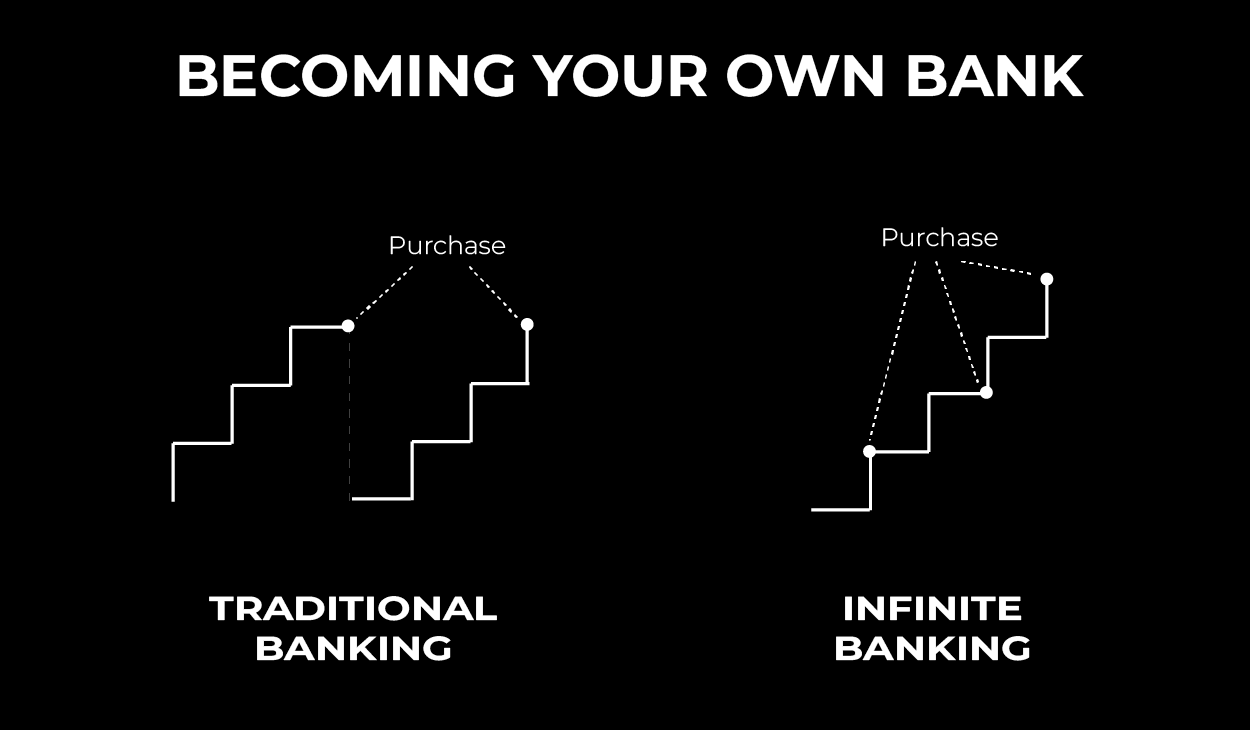

The strategy has its very own advantages, however it also has issues with high fees, intricacy, and a lot more, leading to it being regarded as a fraud by some. Infinite banking is not the most effective plan if you require just the financial investment element. The limitless financial principle focuses on the use of entire life insurance policy policies as a monetary device.

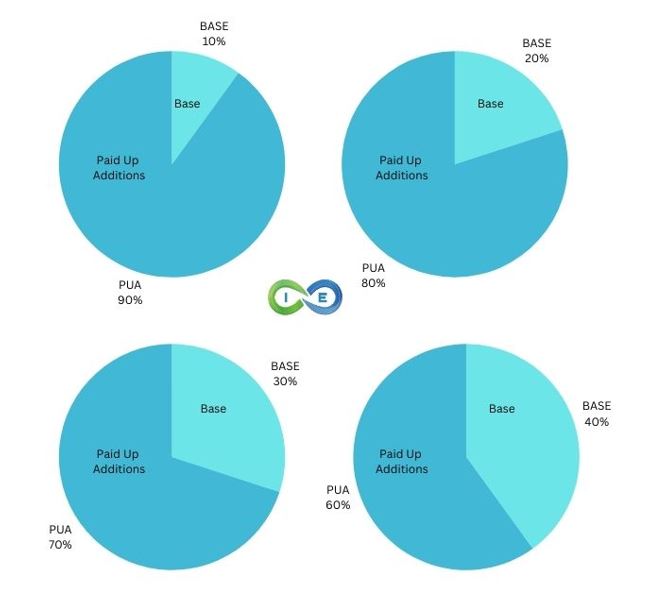

A PUAR permits you to "overfund" your insurance plan right as much as line of it coming to be a Customized Endowment Contract (MEC). When you utilize a PUAR, you rapidly increase your cash money value (and your fatality advantage), thereby boosting the power of your "bank". Further, the even more cash value you have, the better your rate of interest and reward repayments from your insurer will certainly be.

With the increase of TikTok as an information-sharing system, financial guidance and strategies have located a novel method of spreading. One such approach that has actually been making the rounds is the limitless financial principle, or IBC for short, garnering endorsements from celebs like rapper Waka Flocka Flame - Bank on yourself. However, while the method is currently popular, its origins map back to the 1980s when economist Nelson Nash introduced it to the globe.

What is Infinite Banking Cash Flow?

Within these plans, the money value expands based on a price set by the insurance company. Once a considerable cash money worth gathers, insurance policy holders can get a money value lending. These car loans vary from standard ones, with life insurance coverage working as collateral, implying one can lose their coverage if borrowing excessively without appropriate cash money worth to support the insurance policy prices.

And while the allure of these plans is obvious, there are innate restrictions and dangers, demanding thorough cash money value tracking. The strategy's legitimacy isn't black and white. For high-net-worth individuals or local business owner, especially those making use of techniques like company-owned life insurance policy (COLI), the benefits of tax breaks and compound development might be appealing.

The appeal of limitless financial doesn't negate its obstacles: Expense: The foundational demand, a permanent life insurance policy, is more expensive than its term counterparts. Qualification: Not everybody gets whole life insurance coverage because of rigorous underwriting procedures that can omit those with particular wellness or way of life conditions. Intricacy and risk: The intricate nature of IBC, combined with its dangers, might hinder several, specifically when less complex and less high-risk alternatives are available.

Can I access my money easily with Cash Flow Banking?

Alloting around 10% of your regular monthly earnings to the plan is just not viable for many people. Making use of life insurance policy as an investment and liquidity resource requires discipline and surveillance of policy cash value. Speak with a monetary advisor to figure out if limitless banking lines up with your priorities. Component of what you read below is merely a reiteration of what has currently been said over.

Prior to you obtain on your own into a situation you're not prepared for, understand the adhering to first: Although the principle is generally sold as such, you're not actually taking a loan from yourself. If that held true, you wouldn't need to settle it. Rather, you're borrowing from the insurer and need to settle it with passion.

Some social media blog posts recommend making use of money value from entire life insurance policy to pay down credit card financial debt. When you pay back the car loan, a portion of that interest goes to the insurance coverage business.

Can I use Infinite Banking Retirement Strategy to fund large purchases?

For the very first a number of years, you'll be paying off the payment. This makes it exceptionally tough for your plan to build up worth throughout this moment. Whole life insurance policy prices 5 to 15 times extra than term insurance policy. The majority of people just can not afford it. Unless you can pay for to pay a couple of to several hundred bucks for the following decade or more, IBC will not function for you.

If you need life insurance coverage, here are some beneficial tips to think about: Consider term life insurance coverage. Make sure to go shopping about for the ideal price.

How secure is my money with Borrowing Against Cash Value?

Picture never having to stress about financial institution loans or high passion prices again. That's the power of infinite financial life insurance.

There's no collection car loan term, and you have the freedom to choose the payment schedule, which can be as leisurely as settling the financing at the time of fatality. This adaptability encompasses the servicing of the car loans, where you can select interest-only repayments, maintaining the finance equilibrium level and convenient.

Can anyone benefit from Private Banking Strategies?

Holding money in an IUL dealt with account being credited rate of interest can frequently be much better than holding the cash money on down payment at a bank.: You've always dreamed of opening your very own pastry shop. You can obtain from your IUL plan to cover the initial expenditures of renting a room, acquiring tools, and employing team.

Personal lendings can be acquired from conventional banks and debt unions. Below are some vital points to think about. Credit rating cards can provide a flexible way to borrow money for extremely temporary periods. Nonetheless, obtaining cash on a bank card is generally very costly with interest rate of rate of interest (APR) frequently getting to 20% to 30% or even more a year.

Latest Posts

How To Create Your Own Bank

Tbt: How To Be Your Own Bank, Multiply Your Money, And ...

Nelson Nash Whole Life Insurance